Exploring the best countries for affordable private health insurance unveils a world of possibilities for individuals seeking cost-effective healthcare coverage. From examining influencing factors to comparing costs on a global scale, this guide delves into key aspects that shape the accessibility of private health insurance.

Factors influencing the affordability of private health insurance

Private health insurance costs are influenced by various factors that individuals need to consider when choosing a plan. These factors can either increase or decrease the overall affordability of private health insurance based on personal circumstances.

Age

Age is a significant factor in determining the cost of private health insurance. Generally, younger individuals pay lower premiums compared to older individuals. This is because younger people are statistically less likely to require extensive medical care. As individuals age, the risk of developing health conditions increases, leading to higher insurance costs.

Location

The location where an individual resides can also impact the affordability of private health insurance. In areas with higher healthcare costs or where certain medical services are more expensive, insurance premiums tend to be higher. Rural areas may have limited healthcare providers, resulting in higher costs for coverage.

Health Condition

An individual's current health condition plays a crucial role in determining private health insurance costs. Those with pre-existing conditions or chronic illnesses may face higher premiums or exclusions from coverage. On the other hand, individuals in good health typically pay lower premiums as they are less likely to require frequent medical interventions.

Coverage Options

The specific coverage options chosen by individuals can significantly impact the affordability of private health insurance. Plans with extensive coverage, lower deductibles, and more benefits generally come with higher premiums. On the contrary, choosing a plan with limited coverage and higher out-of-pocket costs can reduce monthly premiums.

Strategies to Mitigate Costs

To mitigate the high costs of private health insurance based on these influencing factors, individuals can consider several strategies. These include comparing multiple insurance providers, adjusting coverage options to fit personal needs, maintaining a healthy lifestyle to reduce health risks, and taking advantage of employer-sponsored insurance plans if available.

Comparison of private health insurance costs in different countries

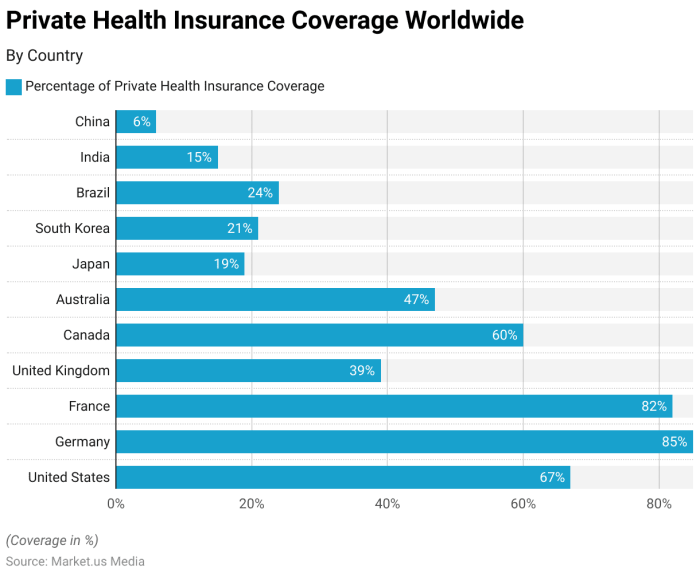

In looking at private health insurance costs in various countries, it is essential to consider the affordability and cost-effectiveness of the plans offered. Different countries have varying approaches to structuring their private health insurance systems, which can impact the overall cost for consumers.

Affordable Healthcare Countries

- Germany: Germany is known for its affordable private health insurance options, with a strong emphasis on quality care at reasonable prices.

- Australia: Australia offers a mix of public and private health insurance options, with competitive pricing and comprehensive coverage.

- France: France has a universal healthcare system that includes private insurance for additional services, making it a cost-effective option for residents.

Trends in Private Health Insurance Systems

- In countries like Germany and France, private health insurance is often used to supplement public healthcare services, offering quicker access to specialists and elective procedures.

- Some countries, like Australia, have a strong regulatory framework to ensure affordability and transparency in private health insurance pricing.

- Countries with a mix of public and private healthcare systems tend to have lower overall costs for private health insurance, as the competition drives prices down.

Benefits and coverage options in countries with affordable private health insurance

In countries with affordable private health insurance, the benefits and coverage options play a crucial role in ensuring access to quality healthcare for residents. These countries have designed their insurance systems to provide comprehensive coverage at reasonable costs, making healthcare more accessible to a wider population.

Types of Benefits and Coverage Options

- Preventive Care: Many countries include coverage for preventive services such as vaccinations, screenings, and annual check-ups to promote early detection and disease prevention.

- Hospitalization: Comprehensive coverage for hospital stays, surgeries, and other inpatient treatments is often included to alleviate the financial burden of expensive medical procedures.

- Outpatient Services: Coverage for consultations, diagnostic tests, specialist visits, and outpatient procedures ensures that individuals can access a wide range of healthcare services without incurring high out-of-pocket costs.

- Prescription Drugs: Affordable private health insurance plans often include coverage for prescription medications, making essential drugs more accessible to policyholders.

Contribution to Affordability and Accessibility

- By offering a wide range of benefits, countries with affordable private health insurance plans help individuals access timely and necessary healthcare services without facing financial barriers.

- Coverage options that prioritize preventive care and early intervention can lead to cost savings in the long run by preventing the progression of diseases and reducing the need for expensive treatments.

- Comprehensive coverage for hospitalization and outpatient services ensures that individuals can seek medical care without worrying about the financial implications, promoting overall health and well-being.

Unique Features and Innovative Approaches

- Some countries have implemented risk pooling mechanisms to distribute healthcare costs more equitably among policyholders, ensuring that premiums remain affordable for all income groups.

- Others have introduced telemedicine services and digital health platforms to enhance access to healthcare services, especially in remote or underserved areas, making healthcare more convenient and cost-effective.

- Countries with affordable private health insurance may also offer incentives for healthy behaviors and wellness programs to encourage preventive care and reduce the incidence of chronic diseases, ultimately lowering healthcare costs for both individuals and insurers.

Challenges and limitations of affordable private health insurance

Private health insurance offers various benefits, but there are also challenges and limitations that individuals may encounter when seeking affordable coverage. These challenges can impact the accessibility and affordability of private health insurance in different countries.

1. Limited Coverage Options

In some countries, affordable private health insurance plans may come with limited coverage options. This can result in individuals not being able to access certain medical services or treatments that they may need. Limited coverage can lead to out-of-pocket expenses, defeating the purpose of having insurance for many individuals.

2. Pre-existing Conditions Exclusions

Another common challenge is the exclusion of coverage for pre-existing conditions. Insurance companies may refuse coverage or charge higher premiums for individuals with pre-existing health conditions. This can make it difficult for people with chronic illnesses to find affordable private health insurance that meets their needs.

3. High Deductibles and Co-payments

Affordable private health insurance plans often come with high deductibles and co-payments. While the monthly premiums may be low, the out-of-pocket costs when seeking medical care can be significant. This financial burden can deter individuals from seeking necessary healthcare services, compromising their health in the long run.

4. Age Restrictions and Premium Increases

Some insurance plans have age restrictions or impose premium increases as individuals get older. This can make it challenging for older adults to afford private health insurance, especially when they may need it the most. The increasing premiums can strain the budgets of seniors on fixed incomes.

5. Lack of Transparency and Complex Pricing

Understanding the pricing and coverage details of private health insurance plans can be challenging due to lack of transparency. Complex pricing structures and hidden costs can make it difficult for individuals to compare different plans and choose the most suitable and affordable option.

This lack of transparency can lead to confusion and dissatisfaction among policyholders.

Strategies to Address Challenges and Limitations

To improve the accessibility of affordable private health insurance, policymakers and insurance companies can consider implementing the following strategies:

- Enhancing transparency in pricing and coverage details

- Introducing regulations to prevent discrimination based on pre-existing conditions

- Offering subsidies or tax credits to make insurance more affordable for low-income individuals

- Encouraging competition among insurers to drive down costs

- Providing education and resources to help individuals understand their insurance options

By addressing these challenges and limitations, countries can work towards making private health insurance more accessible and affordable for their populations.

Closing Summary

In conclusion, the discussion on the best countries for affordable private health insurance sheds light on the intricate balance between cost and coverage. By understanding the complexities of different healthcare systems, individuals can make informed decisions to secure quality insurance without breaking the bank.

Clarifying Questions

Which factors impact the affordability of private health insurance?

The affordability of private health insurance is influenced by factors such as age, location, health condition, and coverage options.

What are some strategies to mitigate high costs of private health insurance?

Individuals can mitigate high costs by exploring different coverage options, maintaining good health, and choosing plans tailored to their needs.

Are there any limitations in coverage that could affect affordability?

Some countries may have limitations in coverage or restrictions that could impact the affordability of private health insurance for certain individuals.