Exploring the realm of Power to Choose No Deposit Plans: Fixed vs. Variable Rates for Texas Homeowners (Guide) opens up a world of possibilities, offering valuable insights and comparisons for those navigating the electricity plan landscape.

In this guide, we delve into the nuances of fixed and variable rates, shedding light on the factors that influence decision-making for homeowners in Texas.

Understanding Fixed vs. Variable Rates

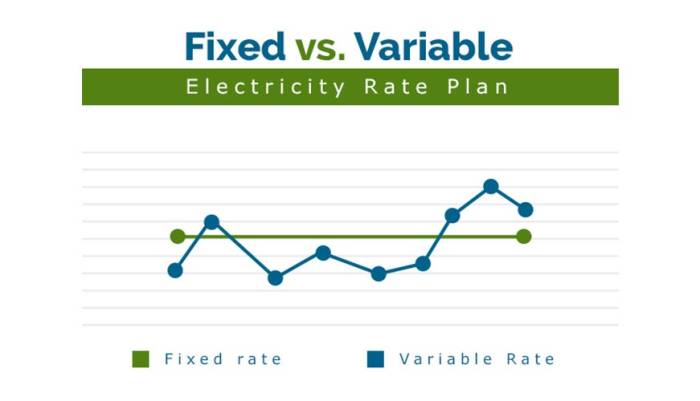

When it comes to choosing an electricity plan in Texas, homeowners often have the option of selecting between fixed and variable rates. Understanding the differences between these two types of rates is crucial in making an informed decision that best suits your needs and budget.

Fixed Rates for Electricity Plans

Fixed-rate electricity plans offer stability and predictability in terms of pricing. With a fixed-rate plan, homeowners pay the same rate for electricity throughout the duration of their contract, regardless of market fluctuations or changes in energy prices. This consistency can help homeowners budget more effectively and avoid surprises on their monthly bills.

Variable Rates for Electricity Plans

On the other hand, variable-rate electricity plans are subject to market changes, meaning the rate you pay for electricity can fluctuate based on factors such as demand, supply, and fuel prices. While variable rates may offer the potential for savings during times of low energy costs, they also come with the risk of higher bills when prices rise unexpectedly.

Benefits of Each Type of Rate for Texas Homeowners

- Fixed Rates:

- Stability and predictability in monthly bills

- Protection against sudden price spikes in the energy market

- Easier budgeting and planning

- Variable Rates:

- Potential for savings during periods of low energy prices

- Flexibility to take advantage of market fluctuations

- No long-term commitment, allowing for plan changes

Factors to Consider When Choosing a Plan

When selecting a no deposit plan for your Texas home, there are several key factors to take into consideration that can impact your overall experience and costs.

Credit Scores Impact

Your credit score plays a significant role in determining the type of plan you can qualify for. Providers often use credit scores to assess the risk of providing service without a deposit. A higher credit score may allow you access to a wider range of plans with more favorable terms.

Contract Lengths Influence

The length of your contract can have a direct impact on the rates you receive for both fixed and variable plans. Shorter contract lengths may offer more flexibility but could come with higher rates. On the other hand, longer contract lengths often provide more stability and potentially lower rates.

Rate Stability Comparison

When comparing fixed and variable rate plans, it's essential to consider the stability of rates. Fixed-rate plans offer consistent pricing throughout the duration of your contract, providing predictability in your monthly bills. Variable-rate plans, however, are subject to market fluctuations, which can lead to unpredictable costs depending on the energy market conditions.

Pros and Cons of Fixed Rate Plans

When considering electricity plans for your home in Texas, it's important to weigh the pros and cons of fixed rate plans. These plans offer stability and predictability, but they may not always be the best choice for every homeowner.

Advantages of Fixed Rate Plans

- Stability: With a fixed rate plan, you can lock in a set rate for the duration of your contract, providing predictability in your monthly electricity bills.

- Protection from Market Fluctuations: Fixed rate plans shield you from sudden spikes in energy prices, ensuring you won't be caught off guard by unexpected increases.

- Long-Term Budgeting: Knowing exactly how much you'll be paying for electricity each month makes it easier to budget and plan your finances.

Drawbacks of Fixed Rate Plans

- Potential Higher Initial Costs: Fixed rate plans may have slightly higher rates initially compared to variable rate plans, which could lead to increased upfront costs.

- No Benefit from Price Drops: While fixed rate plans protect you from price increases, they also mean you won't benefit from any potential decreases in energy prices.

- Early Termination Fees: If you decide to cancel your fixed rate plan before the contract ends, you may incur early termination fees.

When Fixed Rate Plans Are Most Beneficial

Fixed rate plans are most beneficial for homeowners who prefer certainty and stability in their monthly expenses. They are ideal for those who want to avoid the risk of fluctuating energy prices and prioritize consistent budgeting. Additionally, fixed rate plans are a good choice when energy prices are expected to rise in the future, as locking in a set rate can offer savings in the long run.

Pros and Cons of Variable Rate Plans

When it comes to choosing an electricity plan in Texas, variable rate plans offer both advantages and disadvantages that homeowners should consider. Variable Rate Plans

Advantages

Advantages

- Flexibility: Variable rate plans allow homeowners to take advantage of market fluctuations and potentially lower rates during off-peak times.

- No Long-term Commitment: Homeowners are not locked into a fixed rate for an extended period, providing flexibility to switch plans if needed.

- Potential Savings: In certain situations, variable rate plans can result in cost savings, especially during periods of low electricity demand.

Variable Rate Plans

Disadvantages

Disadvantages

- Price Volatility: Variable rate plans can be subject to price fluctuations, leading to unpredictability in monthly bills.

- Risk of Higher Rates: During peak demand periods or market fluctuations, homeowners may end up paying higher rates compared to fixed rate plans.

- Budgeting Challenges: The variability in monthly bills can make it difficult for homeowners to budget effectively, as the amount due may change significantly from month to month.

Scenarios Where Variable Rate Plans are Preferable:

Preferable Scenarios

- Short-Term Living Arrangements: For those planning to move or who are unsure about their long-term housing situation, a variable rate plan offers flexibility without a long-term commitment.

- Risk-Tolerant Consumers: Homeowners who are comfortable with the potential price fluctuations and are willing to take on some risk for the opportunity of savings may find variable rate plans suitable.

- Energy-Savvy Consumers: Individuals who actively monitor energy usage patterns and can adjust consumption based on market conditions may benefit from variable rate plans when prices are low.

Closing Notes

As we conclude our discussion on Power to Choose No Deposit Plans: Fixed vs. Variable Rates for Texas Homeowners (Guide), it becomes evident that the freedom to select the most suitable plan empowers individuals to make informed choices that align with their needs.

Essential Questionnaire

What impact do credit scores have on choosing a no deposit plan?

Credit scores can influence the type of plans available to homeowners, potentially affecting the deposit requirement or eligibility for certain rates. It's crucial to understand this aspect before making a decision.

When are variable rate plans more preferable over fixed rate plans?

Variable rate plans might be beneficial for individuals expecting market fluctuations or planning to stay in a property for a short period. They offer flexibility but come with a level of uncertainty.

Can contract lengths impact the choice between fixed and variable rate plans?

Yes, the length of the contract can influence the suitability of fixed or variable rates. Longer contracts may offer stability with fixed rates, while shorter ones could align better with variable rates.