Exploring the realm of personal finance apps tailored for the digital lifestyle, this guide delves into the key features that empower users to manage budgets, track expenses, and save money efficiently. By comparing various apps, readers will gain insights into which ones suit their digital lifestyles best.

As we navigate through the intricacies of personal finance in the digital age, these apps serve as indispensable tools for financial management and planning.

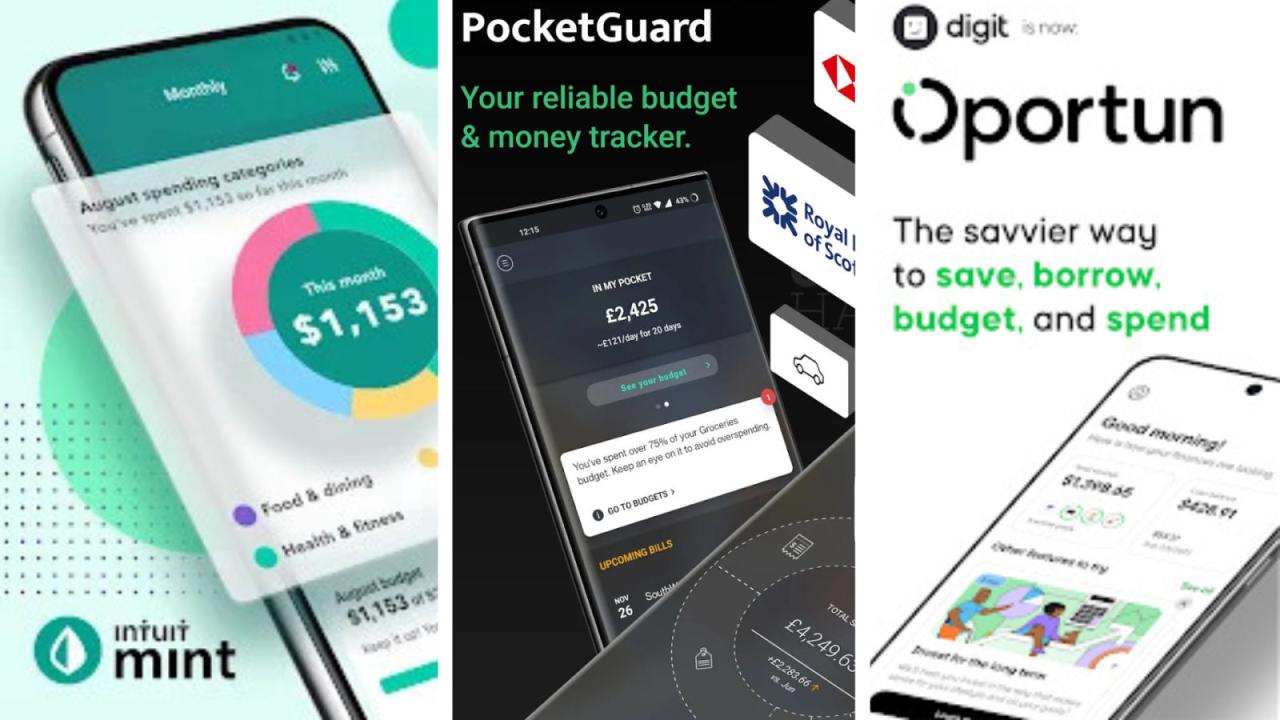

Top personal finance apps for digital lifestyle

Personal finance apps designed for a digital lifestyle offer a range of features to help users efficiently manage their finances. These apps are essential tools for budgeting, expense tracking, and saving money in today's fast-paced digital world.

Key Features of Personal Finance Apps

- Expense tracking: Personal finance apps allow users to easily track their expenses by categorizing transactions, providing insights into spending patterns.

- Budgeting tools: These apps help users create and stick to a budget by setting spending limits for different categories and sending alerts when nearing the limit.

- Saving goals: Users can set specific saving goals, track progress, and receive reminders to stay on track towards achieving financial objectives.

- Financial insights: Personal finance apps offer valuable insights into overall financial health, including net worth, debt management, and investment tracking.

Comparison of Personal Finance Apps

When choosing a personal finance app for your digital lifestyle, consider factors like user interface, security features, integration with other financial accounts, and cost. Here are some popular apps and their suitability for different needs:

| App | Key Features | Suitability |

|---|---|---|

| 1. Mint | Expense tracking, budgeting tools, credit score monitoring | Ideal for users looking for a comprehensive financial management app. |

| 2. YNAB (You Need A Budget) | Zero-based budgeting, goal tracking, financial education resources | Great for users who want to prioritize budgeting and savings goals. |

| 3. Personal Capital | Investment tracking, retirement planning, fee analyzer | Suitable for users focused on long-term financial planning and investment management. |

Accessibility and user-friendliness

Accessibility and user-friendliness are crucial aspects of personal finance apps that can greatly impact the overall user experience. A user-friendly interface makes it easier for individuals to navigate the app, understand their financial information, and make informed decisions regarding their money management.

In addition, accessibility features such as multiple language support and compatibility across different devices ensure that a wider range of users can benefit from these apps.

Intuitive Design for Different Levels of Financial Literacy

Personal finance apps with intuitive designs cater to users with varying levels of financial literacy by simplifying complex financial concepts and presenting information in a clear and easy-to-understand manner. These apps often use visual aids such as charts, graphs, and summaries to help users track their spending, savings, and investments effectively.

Examples of personal finance apps known for their intuitive designs include Mint, YNAB (You Need a Budget), and Personal Capital.

Importance of Accessibility Features

Accessibility features play a significant role in ensuring that personal finance apps are inclusive and user-friendly for individuals from diverse backgrounds. Multiple language support allows non-native speakers to access and utilize the app in their preferred language, enhancing their overall user experience.

Moreover, compatibility across different devices such as smartphones, tablets, and desktops enables users to manage their finances seamlessly regardless of the device they are using.

Security measures and data protection

In today's digital age, safeguarding financial data is of utmost importance when using personal finance apps. Let's delve into the security measures and data protection practices implemented by the top apps in the market

End-to-End Encryption

End-to-end encryption is a critical security feature that ensures that the data exchanged between the user and the app is encrypted and can only be decrypted by the intended recipient. This means that even if a cybercriminal intercepts the data, they would not be able to access sensitive financial information.

Two-Factor Authentication

Two-factor authentication adds an extra layer of security by requiring users to provide two forms of identification before accessing their accounts. This could involve entering a password and then a unique code sent to their mobile device. By implementing two-factor authentication, personal finance apps significantly reduce the risk of unauthorized access.

Biometric Login Options

Biometric login options, such as fingerprint or facial recognition, offer a convenient and secure way for users to access their financial data. By using unique biological characteristics, personal finance apps can verify the user's identity with a high level of accuracy, making it difficult for unauthorized individuals to gain access.

Data Protection Policies and Compliance

Different personal finance apps have varying data protection policies in place to safeguard users' information. It is crucial to choose an app that complies with industry standards and regulations, such as GDPR or HIPAA, depending on the type of data being handled.

Apps that prioritize data protection and adhere to strict compliance measures instill confidence in users regarding the safety of their financial information.

Integration with financial institutions and services

Personal finance apps play a crucial role in integrating with various financial institutions and services to provide a comprehensive overview of an individual's financial health.

Benefits of real-time transaction syncing and automatic categorization of expenses

- Real-time transaction syncing allows users to view their latest financial transactions instantly, helping them stay up-to-date with their spending habits.

- Automatic categorization of expenses simplifies the process of tracking where money is being spent, making budgeting and financial planning more efficient.

- By integrating with banks, credit cards, and other financial institutions, personal finance apps can provide a consolidated view of all accounts in one place, offering convenience and ease of access.

Challenges and limitations of integrating multiple financial accounts within a single app

- One of the challenges faced is ensuring the security and privacy of sensitive financial data when integrating with multiple accounts from different institutions.

- Different financial institutions may have varying levels of compatibility with personal finance apps, leading to potential issues in syncing transactions or accessing certain account features.

- Managing and reconciling transactions from multiple accounts can be complex and may require manual intervention at times, especially when dealing with discrepancies or errors in data syncing.

Final Thoughts

In conclusion, the world of personal finance apps for digital lifestyles offers a plethora of options to streamline financial tasks and enhance money management capabilities. With the right app, users can embark on a journey towards financial success and stability.

Essential FAQs

How do personal finance apps benefit users with different digital lifestyles?

Personal finance apps cater to diverse digital lifestyles by offering features like customizable budgeting tools, automated expense tracking, and real-time financial insights tailored to individual needs.

Are personal finance apps secure for storing financial data?

Top personal finance apps prioritize data security through advanced encryption methods, two-factor authentication, and stringent compliance with industry standards to safeguard users' financial information.

Can personal finance apps sync with multiple financial accounts?

Many personal finance apps support integration with various financial institutions, allowing users to sync and manage multiple accounts conveniently within a single platform for holistic financial management.